+91 9983 203 203

Latest articles on Life Insurance, Non-life Insurance, Mutual Funds, Bonds, Small Saving Schemes and Personal Finance to help you make well-informed money decisions.

|

New pension regime in focus The annuity buying process gains significance in the light of new guidelines by the Insurance Regulatory and Development Authority ( Irda) on pension plans, which have heralded several changes. Under the new regime, policyholders will not have the choice of approaching the insurer which offers the best annuity rates at the time of vesting. This has been done to reduce the burden on PSU behemoth LIC, which rules the space currently. This makes it imperative for the investors to choose wisely while buying a pension plan as they will need to factor in the insurer’s capabilities. "While buying a pension plan, it’s important that you evaluate the insurer thoroughly. In addition to this, you should track how the corpus has been managed over the past few years, the charges and fees, the convenience of transaction and payout history," says Vishal Kapoor, head of wealth management, Standard Chartered Bank. |

|

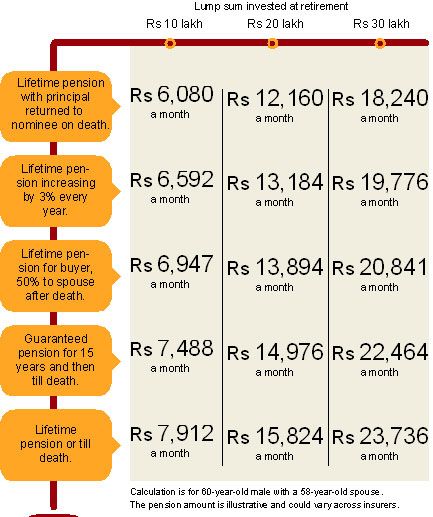

Choosing the right annuity structure Annuities refer to the stream of income an insurer pays at regular intervals until your death or the end of the tenure you may have opted for. The corpus at the end of the accumulation phase will be paid out in two parts -one-third as a lump sum and the balance being converted into annuities. You will need to buy annuities using the amount accumulated by your pension plan or any lump sum. The annuity option you choose will depend on your requirements and expectations from the plan. This will be applicable primarily to those investors who may have built the corpus through pension plans until January this year and others with a fund pool. |

|

Annuity payable for life You will be paid a fixed annuity at regular intervals throughout your life. The insurer will stop paying pension after your demise. This is why annuities are suitable for those who do not have any obligation after death. This option offers the highest amount of pension for an individual compared to any other option available. Annuity payable for life with a guaranteed period Here, annuity is paid for a certain number of years, say, the chosen term of 10 years, and thereafter as long as the annuitant is alive. The shorter the guarantee period, the higher is the pension. The annuity stops upon either the death of the annuitant or completion of the guaranteed period, whichever is later. This is a simpler tool to ensure income for the family for a stipulated period of time. For example, you retire at a time when you are still the sole earning member in the family, but expect your children to start earning after five years. In such a case, you could consider an annuity that is guaranteed for five years. |

|

So, to ensure that you continue to live comfortably in your sunset years, you need to invest wisely in the right type of annuity as well as put money in secure debt instruments. |

|

Copyright © 2026 Design and developed by Fintso. All Rights Reserved