+91 9983 203 203

Latest articles on Life Insurance, Non-life Insurance, Mutual Funds, Bonds, Small Saving Schemes and Personal Finance to help you make well-informed money decisions.

The whole family is covered by a single policy, making a floater cover very cost-effective.

Family Floaters are great alternatives to individual health insurance plans, for a variety of reasons. The cover amount is basically ‘Floats’ amongst all the family members included under the plan, and is equally available to all of them!

They are simpler. The whole family is covered by a single policy. This makes them very convenient to manage, and keep track of. And second, they are very cost-effective.

In this article, let’s learn in detail about floater plans, their benefits, and drawbacks

Here are some of the key features of a family floater that makes them a good option for families to secure their health insurance needs.

One large cover that can be shared across family members

This is one of the most fundamental propositions of family floaters. In an individual policy, a single person can only claim up to the sum insured allocated. But in the case of family floaters, the entire cover will be available for all the family members. So, if any member of the family undergoes a major hospitalization, and needs a large cover, the entire amount may be used for their treatment.

Since it’s less likely that more than one member of the same family will undergo a major hospitalization in a given year, a family floater comes in very handy.

Cost-effective compared to individual plans

Compared to individual policies, a family floater plan offers better and cheaper coverage for the entire family - especially when the age gap between the family members is less. A floater for people nearly the same age will cost considerably less than individual policies of the same cover amount.

Single plan, single policy.

If you take an individual policy for every family member, you’ll have to maintain separate policies for each of them. You’ll also have to pay multiple premiums and keep track of many due dates and terms. But, in a family floater, since all your family members will be covered under one policy, you’ll only have one plan to manage, and a single premium to pay. You’re less likely to miss a payment and have your policy lapse!

But, there are also some drawbacks, you should be careful about.

Chances of one member exhausting the entire cover

Imagine you go to a restaurant with your friends and order an extra-large pizza. While all others are yet to start eating, one of your friends, who is super hungry, picks up one slice of pizza, finishes it, and quickly takes another slice. You look at how hungry he is and realize if he eats 1-2 more slices, you guys won’t have enough left. While this is a very light hearted example - you see what I’m getting to.

If one person of your family ends up using a large part of the sum insured, the rest of you might be left without sufficient health cover. And this can become a huge issue, when multiple members of your family get hospitalised at the same time, or within the year. Such cases could’ve been very rare in the past - but seeing how Covid impacted families in the last two years - it isn’t something we can totally disregard either.

One Incorrect declaration can put an entire family’s plan under scrutiny

If the insurer finds out that you have provided wrong or incomplete medical details - even for one member (be it intentionally or unintentionally) it can affect the entire family’s coverage. The insurer would either cancel the policy entirely or they may apply additional loading charges or impose restrictions to continue the policy. So, one has to be super careful while making declarations (in any health insurance, but), particularly with floater plans.

Who can you cover under a family floater plan?

Under a single-family floater plan, you can insure multiple family members, including yourself, your spouse, up to four dependent children (less than age 25), and up to two parents (or) parents-in-law. Here are some things to note, while finding a good floater plan that fits your needs.

-Some policies also allow the combination of one parent + one parent-in-law to be covered. If that’s your need, make sure you ask your financial advisor about such a policy.

-Usually, you can only cover a maximum of eight people (as the above list) under one floater. However, there’s an exception to this. Max Bupa Family First plan allows the coverage of your extended family as well, up to about 19 relationships under a single policy.

-When the kids reach the age of 25, they will have to be moved to an individual health insurance policy, and removed from the floater.

A common question

In floaters, one person is taken as the primary policyholder/ proposer of the policy. All the other members are added as family. So - what happens when the primary policyholder or proposer of the policy passes away? Is the floater plan canceled?

Well - here’s the answer. If the proposer or the primary policyholder dies, any adult member can become the new proposer. There is a myth going around that the policy lapses when the primary policyholder passes away - that’s not true.

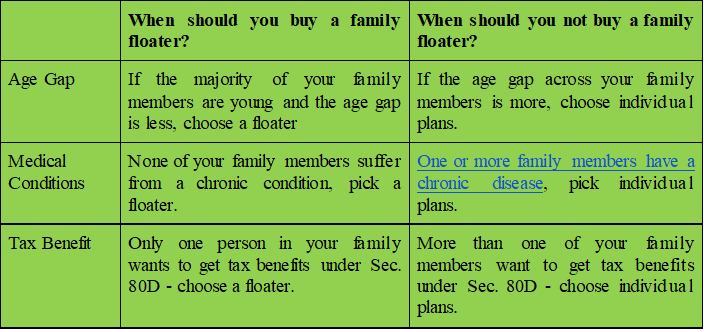

How to decide if you should buy a family floater or not?

How much floater cover should you purchase?

The easiest way to find out how much cover you should buy, simply to multiply the cover you’ll buy for one individual by the total no. of members you’re buying the cover for. For instance, if you think Rs 10 Lakhs will be sufficient for one individual, and you’re buying the cover for 4 members, you must buy Rs 40 Lakhs aggregate cover as a floater. Do not reduce the cover to Rs 20 Lakh or 30 Lakh just because it is a shared cover. This will ensure that every member is adequately covered, at all times, while also keeping your overall costs low.

Copyright © 2026 Design and developed by Fintso. All Rights Reserved