+91 9983 203 203

Latest articles on Life Insurance, Non-life Insurance, Mutual Funds, Bonds, Small Saving Schemes and Personal Finance to help you make well-informed money decisions.

While awareness of life-saving organ transplant surgeries is growing in India, knowledge of health insurance coverage extended to these surgeries may not be as well-known.

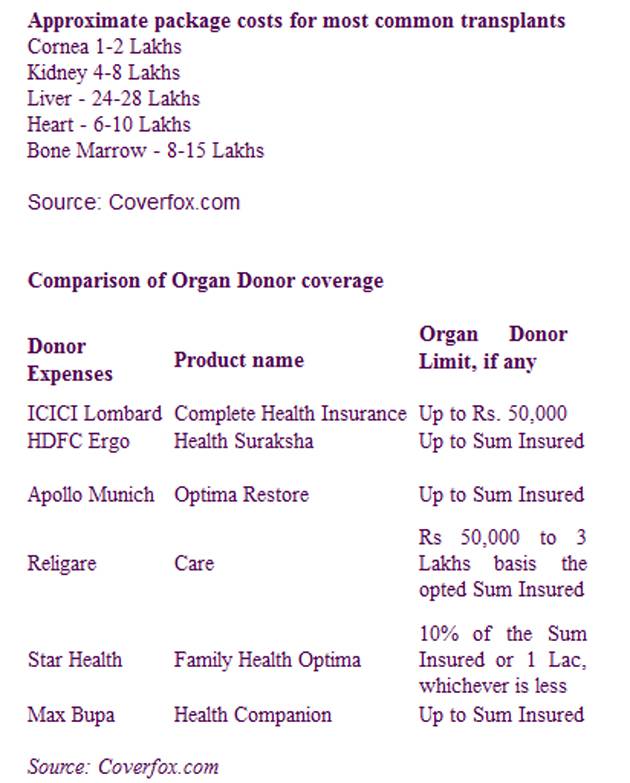

Exorbitant costs of organ transplant make an adequate health insurance cover - and a critical illness cover, too, budget permitting - simply indispensable. Most general insurers today cover organ transplant surgeries as part of their regular policies. They also cover the organ donor’s expenses - some offer to pay reimburse the entire cost, while others place caps on these expenses or offer it as an add-on, or optional, cover.

According to insurance aggregator Coverfox.com, the cost of kidney transplant could range from Rs 4-8 lakh, while a liver transplant could result in an outgo of Rs 24-28 lakh. Having a health insurance cover in place can ensure that you will not have to worry about your finances before giving your assent to a potentially life-saving transplant surgery.

You need to understand the nitty-gritties to make the optimum use of your cover.

Understand the scope of coverage

Any organ transplant entails two people having to undergo surgeries - the insured recipient and the organ donor. All hospitalisation expenses - medical, surgical as well as pre- and post-hospitalisation - incurred by the insured recipient are covered under the policies. Expenses incurred on organ donor for harvesting - that is, surgery and storage of organ - are covered. The treatment expenses of the former will be fully paid for up to to the sum insured of her policy, but cover for donor expenses depends on the insurer (see table). "Organ Donor cover includes hospitalisation expenses for the donor up to a specified limit. Provided that the organ is donated to the insured and the claim is admissible as per the terms and conditions of the health policy, there is no specific exclusion," says Sanjay Datta, chief, underwriting and claims, ICICI Lombard General Insurance.

Scrutinise the exclusions

Remember, the donors cannot get their hospitalisation costs covered under their individual health insurance policy. Therefore, the insured recipient may have to bear such expenses, making it critical to understand admissible and inadmissible expenses, or exclusions, as well as sub-limits.

"The cost of treatment for the organ donor is covered with a limit and only with respect to cost of surgery for harvesting the organ. Other costs associated with the donor’s hospitalisation are generally not covered," says Mahavir Chopra, director, health insurance and personal accident, Coverfox,com, an insurance aggregator portal. Typical exclusions include cost of screening the donor, post-surgical complications and donor’s pre- and post-hospitalisation costs.

On your part, in case of such a surgery, you must ask hospitals for a detailed break-up of costs into donor and recipient expenses. "It is also important to demand a further break-up of donor costs into screening, medical and surgical expenses to understand the financial impact of the exclusions," points outs Chopra.

Copyright © 2026 Design and developed by Fintso. All Rights Reserved